The returns R(t) is taken as a stochastic process indexed by the time parameter, which is generally assumed to be stationary for the purpose of any kind of predictive capability. Stationarity means that the probability that R(t) takes values in a set B does not change with time t.

Additional assumptions are imposed based on the need and appropriateness. The most common additional assumption is normality of the distribution in which case the mean and the variance are estimated from a sample data and used for the purposes of prediction etc.,

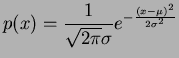

The reason of the assumption of normality is the central limit theorem which says that a sum of independent and identically distributed random variable each having finite variance (suitably normalized) will converge to a random variable which is normally distributed. The normal (or the Gaussian) distribution is one whose probability density function is given by

On the other hand in the recent past it has been discovered in several international

markets [1] that the distribution of returns is not necessarily Gaussian, but is

fat tailed (meaning that it does not have rapid decay as

![]() )

and behaves like

)

and behaves like

The model valid for a given market is important to determine the VaR valid for that market.

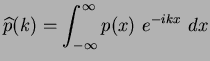

The model building can be done in several ways. One could assume that the distribution

![]() valid for a market has one of the above forms and then go about deciding the parameters

of the model or simply build the model using the relative frequency definition for the

distribution

valid for a market has one of the above forms and then go about deciding the parameters

of the model or simply build the model using the relative frequency definition for the

distribution ![]() , which is the number of times the value

, which is the number of times the value ![]() is taken to the

total number of observations (also known broadly as Historical Simulation).

is taken to the

total number of observations (also known broadly as Historical Simulation).

In all the above we should remember that there is still the assumption of stationarity of the returns over time.