In the recent times, there have been quite a few advances in the study of financial markets especially with respect to risk. A new philosophy of risk containment has emerged as a felt need in almost all the financial markets in the world [2], [3]. Indian markets too caught up with it by introducing several changes in the trading system with a view to risk containment, [5] and there is [4] a comparative study of various models done using the S&P Nifty index data. One of the tools employed is the so called Value at Risk (VaR).

Briefly the VaR is a measurement of the maximum loss that would be incurred at a given probability ![]() for

a financial instrument (and strictly speaking should be written as

for

a financial instrument (and strictly speaking should be written as

![]() associated with a given probability

associated with a given probability ![]() , but we will be imprecise here).

One looks at the VaR for probabilities close to 0.99 and 0.95 (referred to in the

literature in per cent terms as 99% and 95% and so on).

, but we will be imprecise here).

One looks at the VaR for probabilities close to 0.99 and 0.95 (referred to in the

literature in per cent terms as 99% and 95% and so on).

In this paper we shall discuss the issue of the VaR in the Sensex scrips traded

in the BSE. The complete list of scrips is given in the appendix. We took

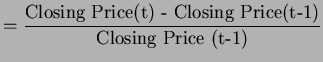

the data of adjusted daily prices put out by CMIE for our analysis. The (normalized)

returns ![]() , at time

, at time ![]() , we calculate are for one day holding given thus:

, we calculate are for one day holding given thus:

We shall give the motivation for our work, briefly review the existing work elsewhere and in India and discuss our findings.